Don’t let your Zong balance disappear while browsing. This code helps you save your balance and make the most of your data.

How Zong Balance Saver Works

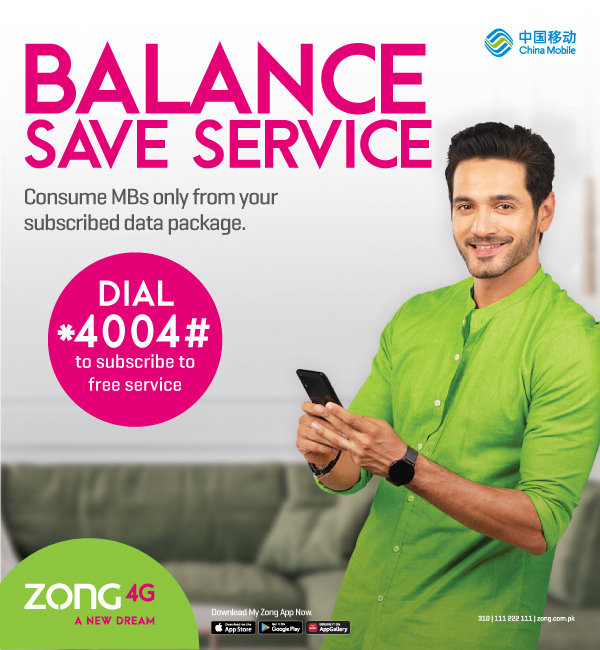

Zong knows that running out of your internet package unexpectedly can be frustrating. To help prevent accidental balance depletion, they offer the Zong Balance Save Code. Activating this code ensures that your data will not be used unless you have an active internet package, thereby preserving your balance. This feature is particularly useful when you’re close to exhausting your data allowance or if you have limited balance, as it helps you avoid unexpected charges and manage your usage more effectively. Additionally, the Zong Balance Save Code provides peace of mind by preventing automatic data consumption and allowing you to control when and how your data is used. It’s a simple and effective way to keep your balance safe and ensure that you only use data when you intend to.

How to Activate Zong Balance Saver 2025

Activating this amazing feature is simple:

- Dial *4004# from your Zong phone.

- Follow the on-screen instructions. It’s that easy!

- Receive a confirmation SMS. Your balance is now protected.

Why Choose Zong Balance Saver?

- Free: This service is absolutely free of charge.

- Easy Activation: Dial a simple code and you’re done.

- Peace of Mind: Browse worry-free, knowing your balance is safe.

Alternative Activation Method: My Zong App

Prefer using the app? You can also activate Balance Saver through the My Zong App:

- Open the app and tap the search icon.

- Type “balance save service.”

- Select the option and tap “Subscribe Now.”

Who Can Benefit?

Both Zong prepaid and postpaid users can take advantage of this incredible service. It’s perfect for those who:

- Frequently forget to turn off mobile data.

- Don’t want to worry about unexpected balance deductions.

- Want to maximize the value of their data plans?

Managing your mobile expenses includes saving balance and making informed purchases, which is why it’s helpful to Check Zong 4G device cost beforehand.

Zong Balance Save Karne Ka Tarika (How to Save Zong Balance):

Zong Balance Saver is your ultimate solution to prevent accidental data usage and keep your balance intact. Say goodbye to unexpected charges and hello to worry-free browsing!

Get Started Today!

Don’t let your Zong balance disappear. Activate Zong Balance Saver 2025 now by dialing *4004# or through the My Zong App. Start stretching your data further and enjoy a stress-free internet experience!

Note: To deactivate, follow the same steps and choose the unsubscribe option.

Stay Connected with Zong:

For more tips on saving your Zong balance and the latest offers, stay tuned to our updates and website. Zong is committed to providing you with the best possible service.

How to Activate Zong Balance Save Code?

To activate the Zong Balance Save Code, follow these steps:

Dial the Activation Code: Enter the code *123# on your Zong mobile phone.

Confirm Activation: Follow the on-screen instructions to activate the balance save feature.

What is the Number Code for Zong Balance?

The number code for Zong Balance Save is *123#. This code helps manage and protect your balance by preventing data usage unless you have an active internet package.

What are the Codes for Zong?

Zong provides various codes for different services. Here are a few commonly used codes:

- Balance Check Code: *222#

- Internet Package Activation Codes: Vary depending on the package. For example, *455# for some packages.

- Balance Save Code: *123#

How to Get Zong Free MBs Without Balance?

To get free MBs on Zong without balance, you can check for any ongoing promotions or offers by dialing *225# or visiting Zong’s official website or app.

How Can I Get Free 6 GB on Zong?

To get free 6 GB on Zong, look for specific promotional offers or packages. You may need to dial *225# or check Zong’s website or app for any available promotions.

How to Get Free Internet?

To access free internet on Zong, keep an eye on special promotions and offers. You can dial *225# to check for current offers or visit Zong’s official website or app for details on free internet promotions.