Jazz customers who are going to open a Jazz cash account can check Jazzcash Withdrawal Charges List 2024. You can pay your utility bills by using this Mobile bank account, and much more. This mobile account is quite similar to the bank account on your mobile. All these benefits are just available in minor deductions which will be very suitable for such a busy lifestyle. You just need to have the mobile phone all along with the active verified sim.

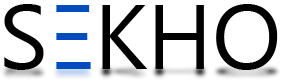

Transaction Via Mobilink Bank, JazzCash Agent:

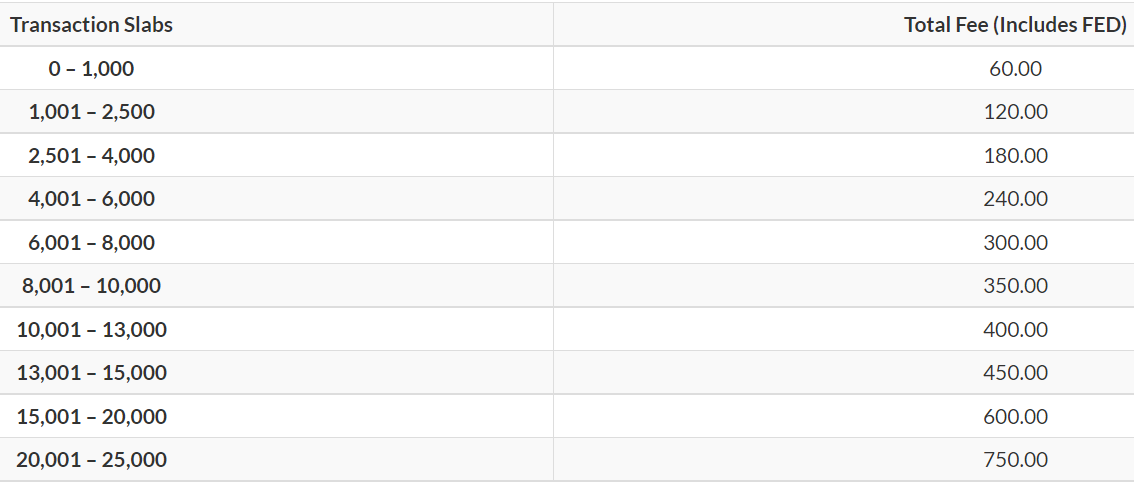

“JazzCash charges from CNIC to CNIC“

Cash Withdrawal through Jazz Agent.

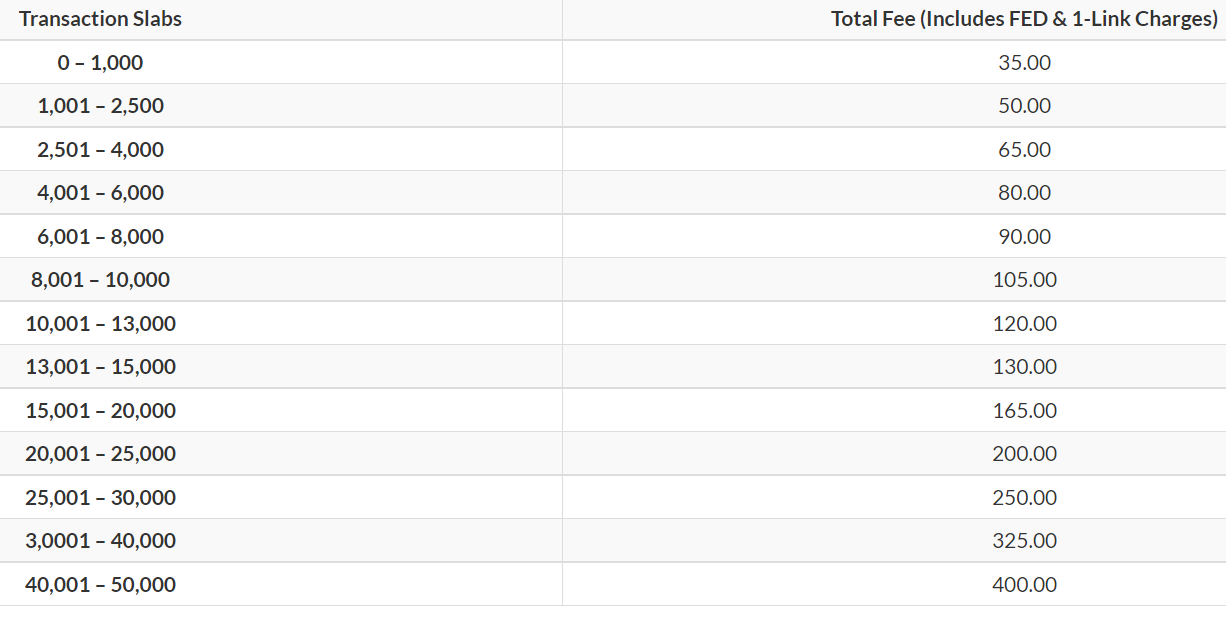

Send Money from CNIC To a Bank Account.

How to Get Jazz Cash ATM Card:

Mobilink Jazz is offering a jazz cash ATM card which is also known as the VISA debit card of the JazzCash account. A person can get his JazzCash ATM card by ordering Online for Just 599. So if you want to check how to get a Jazz Cash ATM card then follow the below steps.

- Open Google Chrome.

- Visit the Jazz Cash Website which is www.Jazzcash.com.pk

- Go to the Visa debit card option

- Now go to the Order Card option.

- Click on Order Now.

- Provide details including your Number and CNIC number.

- You must have more than 599 in your account to order an ATM card.

- Click on next to confirm your Address etc where the card will be delivered.

Jazz cash is a mobile banking account that a Jazz sim holder can activate by simply following the method. If you face any issue regarding them contact on Jazz helpline and share their problems. This Jazz Cash account has different benefits including mobile banking facilities you can send and receive money anywhere in Pakistan.